The natural beauty of a sunset on a vast horizon can be breathtaking. However, there are a small number of sunsets that most taxpayers hope to never experience. Unfortunately, this article is a discussion of the latter – but taxpayers should prepare for potential changes instead of kicking the can to 2025.

WHAT’S CHANGING?

The Tax Cuts and Jobs Act (TCJA), a comprehensive tax overhaul passed in 2017, brought about a number of modifications and reductions to the inheritance and income taxes. A lot of these modifications were scheduled to terminate, or sunset, at the end of 2025. It is critical that clients factor these changes into their planning if their estate are (or could later be) of a significant size such that estate taxes could apply.

ESTATE TAX SUNSET

The lifetime estate and gift tax exemption is perhaps the most significant tax relief that will expire after 2025. Prior to 2018, each individual was exempt up to $5 million, or $10 million for married couples. These caps are $12.92 and $25.84 million for 2023, respectively. The amounts are set at $13.61 million for individuals and $27.22 million for couples in 2024.

As things stand under current legislation, the estate tax exemption will revert to its pre-TCJA level of $5 million per person after 2026. The amount will be adjusted for inflation, and it is anticipated that it will be roughly $7 million per individual.

Lifetime gifting is a gift in itself, providing the opportunity to observe how one’s heirs use the money they have been given. Affected families may benefit financially and in other ways by giving these presents, whether they are intended for their children, grandchildren, or someone else.

TAX STORM COMING?

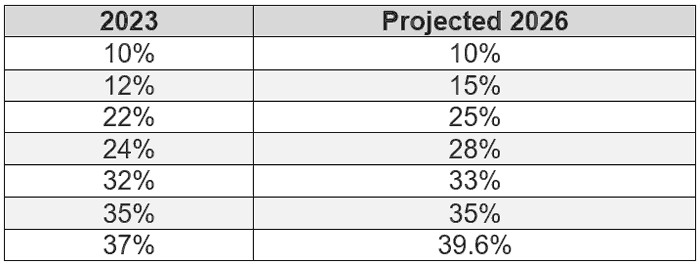

The TCJA cut the marginal tax brackets for the vast majority of taxpayers. Before 2018, the top marginal rate for filers who were married or single dropped from 39.6% to 37%. Most income levels have seen a drop in marginal rates. The seven marginal tax bands that include almost all taxpayers are in are compared here.

CHANGES FOR STANDARD DEDUCTION FILERS TO CONSIDER

Notably, the TCJA raised the standard deduction, which makes it more difficult for a large number of taxpayers to claim itemized deductions. These increased standard deduction amounts will essentially return to the pre-TCJA levels, which were $6,350 for single filers and $12,700 for married couples filing jointly, both of which were inflation-indexed.

The standard deductions for 2023 are $27,700 for married joint filers and $13,850 for single filers. These deductions are $14,600 and $29,200 for 2024.

MORTGAGE INTEREST DEDUCTION

The deduction of mortgage interest is another noteworthy development. For loans obtained after 2017, the TCJA restricted the amount of mortgage interest that could be written off to the first $750,000 of mortgage debt. This cap will return to the $1 million pre-2018 cap.

Since the passing of TCJA, mortgage interest deductions for home equity loans were restricted to loans for house rehabilitation and repair. After 2025, this restriction will be removed, allowing borrowers to write off interest on the first $100,000 of home equity debt.

LINGERING UNCERTAINTY ?

While certain TCJA provisions are expected to expire after 2025, there will be a presidential election in 2024. The result of this election could have an impact on the entire tax environment. This covers not just the party that wins the presidency but also the party that takes over the Senate and the House of Representatives.

WHAT CAN CLIENTS DO TO PREPARE THEMSELVES FOR POTENTIAL CHANGES TO THE TAX LANDSCAPE?

Clients should discuss these expected tax changes with their wealth advisor to evaluate the terms of any potential adjustments to their financial plan. Additionally, you should confirm that their estate planning and tax professionals are involved as needed.

If you have any questions about how you can effectively develop a financial plan, schedule an appointment today!

SOURCES

- https://crsreports.congress.gov/product/pdf/R/R47846

- https://www.thinkadvisor.com/2023/11/22/these-tax-cuts-are-sunsetting-in-2026-are-your-clients-ready/

This information does not constitute legal or tax advice. PCIA and its associates do not provide legal or tax advice. Individuals should consult with an attorney or professional specializing in the fields of legal, tax, or accounting regarding the applicability of this information for their situations. Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite 150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Certain services may be provided by affiliates of PCIA.